Confidential Investment Memorandum

Tim McGraw

Entertainment Holdings

Country, Rodeo & Immersive Entertainment Platform

December 2025 • Nashville, Tennessee • Not For Distribution

Investment Overview

Executive Summary

TMEH is a platform consolidation play in country, rodeo, and immersive entertainment anchored by Tim McGraw's established brand assets. The $300M raise funds: (1) buyout of existing minority investors across fragmented entities, (2) expansion capital for live events and experiential hospitality, and (3) selective M&A in publishing and western lifestyle verticals.

Market Context: Country music streaming grew 57% since 2020 (now #1 genre). Nashville tourism exceeds 20M annually with a $2.1B NFL stadium opening 2027. Western entertainment valuations have compressed (PBR: $3.25B sale). These sectors remain fragmented with no integrated platform operator at scale.

Investment Thesis: Platform consolidation with hard asset backing. The $72–80M music catalog provides downside protection (12–13% of post-money). Multiple revenue verticals reduce single-segment dependency. The rollup structure creates immediate enterprise value from currently subscale, fragmented operations.

Financial Highlights

The Ask

- Raise: $300M

- Ownership: 50% of platform

- Pre-Money: $300M

- Post-Money: $600M

- Use: 33% consolidation, 50% growth, 17% M&A

Downside Protection: $72–80M music catalog + real assets provide hard floor protection (12–13% of $600M post-money).

Market Timing

Why Now: Five Forces Converging

TMEH sits at the intersection of five macro forces that are creating a once-in-a-generation opportunity to build an integrated entertainment platform.

Country Surge

#1 streaming genre in America. +57% growth since 2020.

Nashville Boom

20M+ visitors. $2.1B stadium 2027.

Rodeo Explosion

Houston: $224M revenue. PBR sold for $3.25B.

Immersive Boom

Dollywood: $252M/yr. Stadium-adjacent growing.

No Competitor

Zero integration at this scale. TMEH is first.

TMEH is positioned to capitalize on converging market forces.

Timing advantage: 24–36 months ahead of the 2027 stadium catalyst.

Sources: Luminate 2024 (streaming data); Nashville CVB (tourism); NFL.com (stadium); Houston Rodeo Economic Impact Report 2024; Sports Illustrated Oct 2024 (PBR); Forbes 2021 (Dollywood)

The Brand Asset

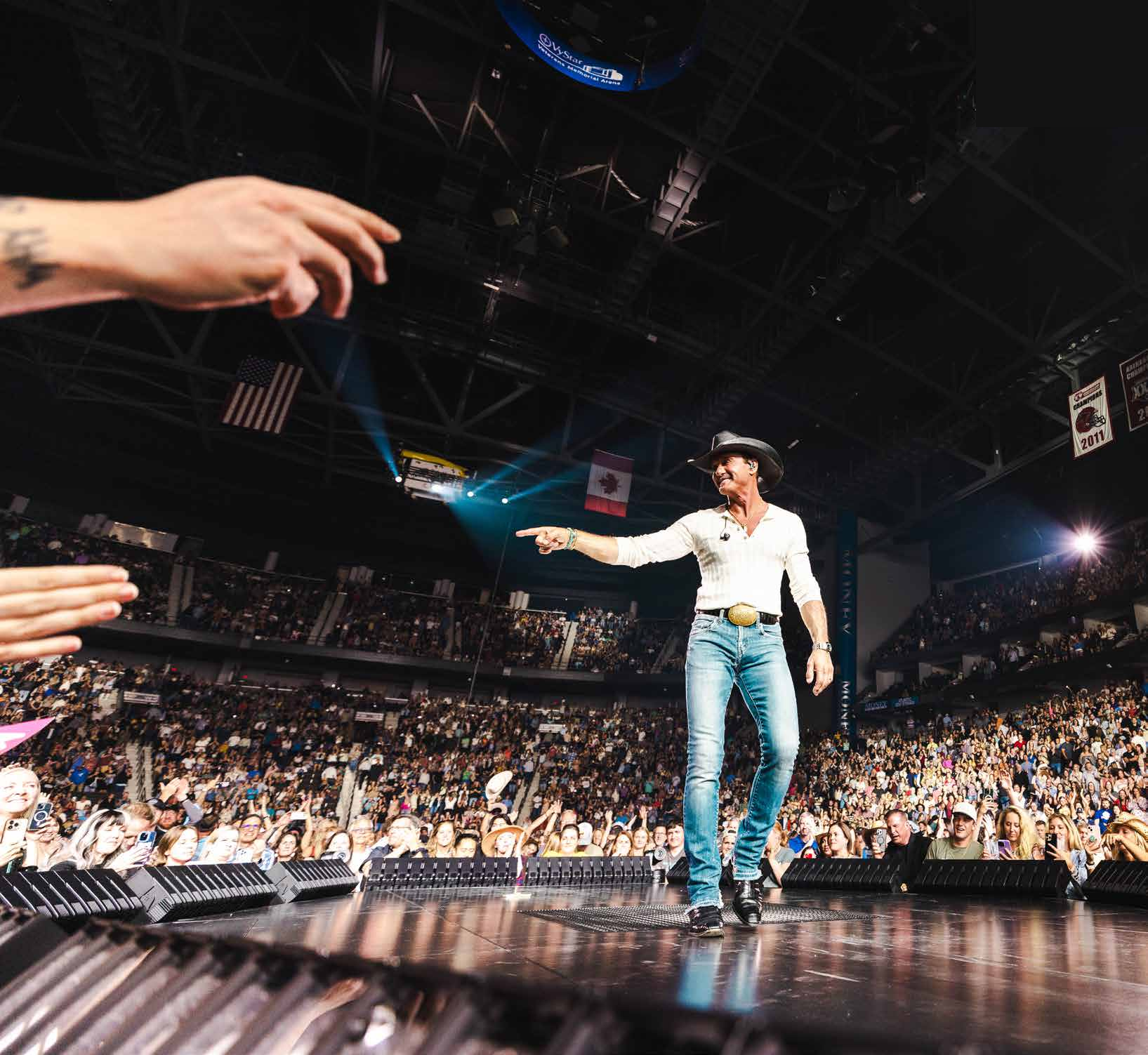

Tim McGraw

A 30-year, cross-generational American icon with unmatched credibility across music, film, television, and sports. Tim McGraw is not just a celebrity—he is a scalable, multi-vertical brand asset.

Music Legacy

- 90M+ albums sold worldwide

- 46 #1 singles (record-breaking)

- 3 Grammy Awards

- 14 CMA Awards, 18 ACM Awards

- 30+ consecutive years touring

Film & Television

- Friday Night Lights (Film)

- The Blind Side ($309M box office)

- $1B+ total box office

- 1883 (Yellowstone franchise)

- Country Strong, The Shack

- Multiple producing credits

Sports Heritage: Son of MLB legend Tug McGraw—2× World Series champion (1969 Mets, 1980 Phillies). Tim carries authentic sports credibility that cannot be manufactured. This is why rodeo and sports ventures are authentic extensions, not celebrity cash grabs.

Downside Protection

The Hard Asset Floor: Music Catalog

Before discussing growth, let's establish the floor. Tim McGraw's music catalog is a tangible, income-producing asset that provides significant downside protection for investors.

Revenue Streams

- Masters & Publishing — Album & single recordings

- Performance Royalties — BMI/ASCAP collection

- Film/TV Sync — Placements & licensing

- Neighboring Rights — International collection

- Streaming — Growing +57% since 2020

Why This Protects Investors

- Predictable, recurring annual cash flow

- Inflation-resistant real asset

- Bankable collateral for financing

- Independent exit path (catalog sale)

- 12–13% of post-money as hard floor ($80M / $600M)

At $600M post-money, the catalog alone represents 12–13% hard asset floor protection. Combined with venue assets, content library, and brand value, downside is substantially de-risked.

Catalog multiples per Billboard, Hipgnosis Songs Fund reports 2024; "most valuable" catalogs now trade 17–20×

The Core Problem

Value Trapped in Fragmentation

Today, Tim McGraw's business empire is scattered across multiple entities with different investors, different terms, and no unified strategy. This fragmentation makes the assets uninvestable for institutional capital.

Down Home Media

Content studio with fragmented ownership:

- Tim McGraw: 32.5%

- Shareability: 32.5%

- Skydance: 15%

- Other minorities: 20%

Music City Rodeo

Live event needing consolidation:

- 17 different investors

- Imbalanced equity structure

- Proof of concept achieved

- Needs funding to scale

Other Assets

Scattered across entities:

- EMCo: Separate management co

- TruMav: Independent brand

- Royalties: Not centralized

- NIL: Unexploited

THE RESULT:

- Value trapped — Each entity subscale and siloed

- Synergies unrealized — Content doesn't feed events, events don't feed hospitality

- Operations duplicated — Multiple back offices, multiple overhead structures

- Uninvestable — No institutional investor can underwrite this structure

This is exactly why TMEH exists—to solve this problem and unlock the trapped value.

The Solution

One Holding Company. Complete Control.

TMEH consolidates all assets under a single holding company with one cap table, one P&L, and one unified strategy. This is a rollup, not a startup.

Clean Cap Table

One set of aligned owners

Consolidated P&L

Full transparency & synergy tracking

Enterprise Value

Whole greater than sum of parts

Consolidation creates immediate value through operational synergy, clean governance, and the ability to cross-sell across all platform touchpoints.

Platform Overview

Six Revenue Engines

Music City Rodeo

Nashville's premier western entertainment event, scaling to 5 markets.

McGraw Draft House

Immersive dining & entertainment venue in Nashville's stadium district.

Down Home Media

Content studio with Skydance partnership. Film, TV, music content.

Music Catalog

Masters, publishing, sync. Predictable, inflation-resistant cash flow.

TruMav & Consumer

Merchandise, licensing, brand extensions. High-margin revenue.

NIL & Brand Extensions

Strategic investments, licensing deals, and brand partnerships.

Capital Deployment

Use of Funds: $300M

| Category | Amount | % |

|---|---|---|

| MCR Buyout & Expansion | $55M | 18% |

| Down Home Consolidation | $45M | 15% |

| Draft House Development | $50M | 17% |

| Brand Ventures & Hospitality | $35M | 12% |

| Strategic M&A Reserve | $50M | 17% |

| Platform & Operations | $25M | 8% |

| Content Fund (Down Home) | $15M | 5% |

| Working Capital & Reserves | $25M | 8% |

| Total | $300M | 100% |

Strategic M&A ($50M)

- Publishing: Country catalogs & songwriter rights

- Live Events: Regional rodeos & festivals

- Hospitality: Branded experiential assets

Additional M&A capital available via follow-on raise once platform proven.

Capital Efficiency.

$300M fully funds consolidation + growth. M&A reserve is disciplined—

larger acquisitions funded by follow-on capital tied to milestones.

Allocation: 33% consolidation, 50% growth capital, 17% M&A reserve. Right-sized for platform buildout with institutional returns.

Rollup Mechanics

Consolidation & Growth Capital

| Target | Amount | What We Acquire | Result |

|---|---|---|---|

| Music City Rodeo | $45M | Partner buyout + investor rollup | 100% ownership |

| Down Home Media | $50M | Shareability's 32.5% + 20% minorities | 85% control |

| EMCo | $4M | Management co, back office, 30-year ops team | 100% owned |

| Catalog Contribution | $72–80M | Tim's contribution to holdco (not cash) | 100% centralized |

| TOTAL CONSOLIDATION | ~$100M cash | + $72–80M catalog contribution | |

What Consolidation Unlocks

- Content feeds events feeds hospitality feeds content

- Single P&L enables proper reporting and governance

- Centralized sponsorship ($30M+ addressable)

- Unified brand strategy across all touchpoints

- Cross-sell and cross-market to shared customer base

EMCo Valuation Rationale

- Annual earnings: ~$500K net

- Multiple: 6–8× (mgmt co standard)

- Implied value: $3–4M

- Strategic value: 30+ years operations, $500M+ managed

- Continuity: Team stays, knows the business

Live Events Division

Music City Rodeo: Scale Strategy

Year 1 Actuals (2024)

Year 1 Learnings:

- Talent overspend: $1.79M cash + equity giveaways

- Sponsorship underdeveloped: $450K vs $2M+ potential

- Comps at 16% with 50% no-show rate

- Admin bloat: $3.87M (startup costs, inefficiencies)

Platform Fixes (Year 2+)

- Talent strategy: Cash only, no equity dilution

- Sponsorship team: Dedicated sales at TMEH level

- Comps cut: 8% max with attendance enforcement

- Admin reduced: 70% via EMCo integration

- Year 2 target: Breakeven or small profit

Expansion Roadmap:

- Year 2: Nashville optimized → breakeven

- Year 3: +2 markets ($7.5M launch each)

- Year 4: +1 market, Nashville scales

- Year 5: 5 markets, stadium move

Year 5 Target: $70M Revenue | Houston Rodeo Comp: $224M Revenue, 2.5M Attendance

Brand Ventures

Immersive & Experiential Division

Following the Margaritaville playbook: asset-light licensing + owned flagship properties. Jimmy Buffett built $1.5B in sales with 31 hotels and 150+ restaurants. We start with Draft House + artist-driven hotels.

McGraw Draft House

Premium sports bar + live music venue in Nashville's $2.1B NFL stadium district.

- Titans partnership secured

- Stadium opens 2027, Super Bowl 2028

- Flagship + 1 additional location Y5

- 25-35% EBITDA margins

- Expansion to 5+ locations post-Y5

Artist-Driven Hotels

Boutique lifestyle hotels with live music integration. McGraw + EMCo artist-branded properties.

- McGraw flagship Nashville

- EMCo roster artist brands

- Partner co-investment model

- Target: Nashville, Austin, Vegas, Dallas

- 4 properties by Year 5

Experiential Concepts

Immersive entertainment beyond Western themes—sports, music, culture experiences.

- Immersive theatrical experiences

- Nashville + expansion markets

- Partner-driven development

- TruMav health/fitness brand

- Consumer products licensing

Combined Brand Ventures Y5 Target: $101M revenue

Margaritaville did $1.5B with one artist. We have Tim + the entire EMCo roster.

Growth Through Acquisition

Strategic M&A: $100M Reserve

TMEH is positioned to be the consolidator in fragmented western lifestyle, country entertainment, and media verticals. $100M dedicated M&A capital enables disciplined, accretive acquisitions.

Publishing

Country music catalogs and songwriter rights acquisitions.

- 15–18× multiples

- Recurring royalty streams

- Sync opportunities via Down Home

- Estate and catalog deals

Media & Distribution

Western lifestyle networks and digital platforms.

- Linear TV networks

- Digital/streaming platforms

- Podcast networks

- Content libraries

Live Events

Regional rodeos and western lifestyle festivals.

- Regional rodeo roll-up

- Festival properties

- Fair circuit relationships

- Venue partnerships

Hospitality

Branded hotel and experiential assets.

- Boutique hotel properties

- Dude ranch acquisitions

- Experiential venues

- F&B concepts

M&A Criteria

- Strategically aligned with TMEH verticals

- Accretive to platform EBITDA

- Synergy potential (content, sponsorship, cross-sell)

- Reasonable valuations (avoid auction dynamics)

- Strong management or integration path

Target Verticals

Active pipeline under evaluation across publishing, media/distribution, live events, and hospitality. Western lifestyle and country entertainment remain highly fragmented with limited institutional ownership— creating significant consolidation opportunity for a well-capitalized platform.

Valuation Context

Comparable Transactions & Precedents

TMEH's $600M post-money valuation benchmarks against recent transactions in adjacent verticals: live entertainment, music IP, and celebrity-brand platforms.

| Transaction | Value | Multiple | Relevance |

|---|---|---|---|

| PBR (Professional Bull Riders) | $3.25B | ~8× Rev | Western entertainment / live events |

| Hipgnosis Song Fund | $2.2B | 17–20× NPS | Music catalog valuation multiples |

| Sphere Entertainment (MSG spinoff) | $2.8B | N/A | Immersive venue / entertainment |

| Dollywood (implied) | ~$700M | ~3× Rev | Artist-branded experiential |

| TMEH (This Transaction) | $600M | 2.7× Y5 Rev | Integrated platform play |

Dollywood Case Study

- Revenue: $252M annually (2024)

- Visitors: 3M+ per year

- Market: Pigeon Forge (5M metro)

- Built over: 35+ years, bootstrapped

TMEH Structural Advantages

- Market: Nashville (20M+ tourists vs 5M)

- Timing: NFL stadium catalyst 2027

- Verticals: Rodeo, content, hospitality integration

- Capital: $300M right-sized for platform buildout

PBR: Sports Illustrated Oct 2024; Hipgnosis: Billboard 2024; Dollywood: Forbes 2021; Sphere: SEC filings

Financial Projections

5-Year Revenue Build (Base Case)

| Division | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Notes |

|---|---|---|---|---|---|---|

| Music City Rodeo | $6M | $12M | $25M | $45M | $70M | Y2 breakeven, +2 markets Y3 |

| Draft House | — | — | $15M | $35M | $55M | Opens Y3 with stadium |

| Down Home (Content) | $5M | $12M | $22M | $30M | $38M | Skydance pipeline ramp |

| Royalties | $4M | $4.5M | $5M | $5.5M | $6M | Steady growth |

| TruMav / NIL / Consumer | $3M | $6M | $12M | $20M | $30M | Brand extensions |

| Sponsorship (Platform) | $2M | $5.5M | $11M | $19.5M | $26M | Cross-platform deals |

| Total Revenue | $20M | $40M | $90M | $155M | $225M | |

| EBITDA | ($5M) | $4M | $18M | $39M | $65M | 29% margin at scale |

Revenue Growth

Y5 EBITDA Margin

Y5 EBITDA

Exit Multiples

Sensitivity Assumptions

Revenue drivers: MCR expansion (±20% variance), Draft House occupancy (±15%), Down Home content deals (±25%). Margin risk: Labor costs, venue buildout overruns. Detailed sensitivity tables available in data room.

Entertainment platform multiples per PitchBook/CB Insights; Live Nation trades at 14×, MSG at 12×

Return Analysis

Multiple Paths to Significant Returns

| Scenario | Y5 EBITDA | Multiple | Enterprise Value | Investor 50% | MOIC | IRR |

|---|---|---|---|---|---|---|

| Downside Floor | $45M | 8× | $360M | $180M | 0.6× | -10% |

| Conservative | $55M | 10× | $550M | $275M | 0.9× | -2% |

| Base Case | $65M | 10× | $650M | $325M | 1.1× | 2% |

| Target | $90M | 12× | $1.08B | $540M | 1.8× | 12% |

| Upside (M&A Success) | $110M | 12× | $1.32B | $660M | 2.2× | 17% |

Exit Paths

- IPO: Entertainment platform public offering

- Strategic: Live Nation, MSG, Liberty Media

- Division Sale: Rodeo, hospitality, content separately

- Catalog Sale: Hipgnosis, Primary Wave, PE funds

- Secondary: PE recap if milestones hit

Downside Protection

- $72–80M catalog = 12–13% of post-money

- Real assets: venues, content library, contracts

- Break-up value: divisions sellable individually

- Liquidation preference on invested capital

- Multiple exit options = no single point of failure

Market Opportunity

Addressable Market Analysis

TMEH's realistic addressable market is defined by Nashville tourism, country music, and western entertainment— not theoretical global TAMs.

Total Addressable Market (TAM)

- Nashville tourism: $10B annually

- Country music industry: $4.5B

- Rodeo/western entertainment: $3.5B

Serviceable Addressable (SAM)

- Nashville experiential venues: $800M

- Regional rodeo market: $1.2B

- Country content production: $500M

- Artist-branded hospitality: $500M

Serviceable Obtainable (SOM)

- MCR + Draft House: $95M

- Down Home content: $44M

- Brand/consumer: $56M

- Sponsorship: $30M

Market Position: TMEH targets 7.5% of SAM by Y5—achievable through existing assets + disciplined expansion. No competitor operates across all three verticals at scale.

Nashville CVB 2024; CMA Industry Report; Houston Rodeo Economic Impact; PBR/TKO filings

Leadership

Experienced Operators & Governance

Executive Chairman

Tim McGraw

Founder & Brand Principal

- 30+ years brand building

- Platform face & credibility

Scott Siman

- 30+ years McGraw manager

Kelly Clague

- 25 years music & entertainment

- Day-to-day operations

Brian Kaplan

- Co-Founder, Down Home

- Co-Founder, Music City Rodeo

- 25+ years music & entertainment

Al Hagaman

- 30 years McGraw business mgr

- Full financial operations

Board Composition (Post-Close)

- Tim McGraw — Executive Chairman

- Scott Siman — CEO (Management)

- 2 Investor Directors — Investor-designated

- 2 Independent Directors — Entertainment/hospitality expertise

Key Man Risk Mitigation

- Operating independence: EMCo/Scott Siman manages day-to-day

- Professional management: Leadership not dependent on talent

- Hard assets: Catalog + real estate retain value independently

- Long-term lockup: Tim contractually committed to platform

- Talent pipeline: Other artists to be brought into mix for projects

Competitive Moat

Why This Platform Wins

TMEH's competitive position derives from structural advantages that would require years and significant capital to replicate.

McGraw brand = trusted, national, 30-year equity

$75M catalog = hard asset downside floor

EMCo = 30+ years proven operations team

Music City Rodeo = scalable live entertainment

Draft House = experiential anchor venue

Stadium timing = Nashville 2027, Super Bowl 2028

Down Home = Skydance content engine

Rodeo division = massive TAM unlock

Brand extensions = long-term growth

Rollup = instant enterprise value creation

Barriers to Entry: Replicating this combination would require: (1) a 30-year established brand, (2) existing operating assets, (3) Nashville market timing, and (4) significant capital—a multi-year, multi-hundred-million-dollar effort.

The Investment

The Ask

Pre-Money

$300M

Post-Money

$600M

Target MOIC

1.8–2.2×

Target IRR

12–17%

Hard Asset Floor

$72–80M Catalog (12–13%)

Use of Funds

33% Rollup, 50% Growth, 17% M&A

Y5 Revenue

$225M / $65M EBITDA

Platform consolidation with hard asset protection, multiple revenue verticals, and defined growth catalysts. Structured for institutional capital deployment.

TMEH

Tim McGraw Entertainment Holdings

For more information, please contact:

Scott Siman • Brian Kaplan

Scott@em.co • Brian@em.co

This presentation is confidential and intended solely for the recipient. It contains forward-looking statements and projections that involve risks and uncertainties. Actual results may differ materially from those projected. This document is not an offer to sell or a solicitation of an offer to buy any securities. Any investment decision should be made based on the information contained in the definitive offering documents.

December 2025 • Nashville, Tennessee